Article 325bb Expected shortfall risk measure | Regulation 575/2013/EU - Capital Requirements Regulation CRR (UK CRR as onshored by HM Treasury) (Retained EU Law) | Better Regulation

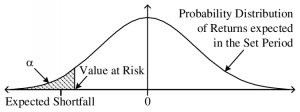

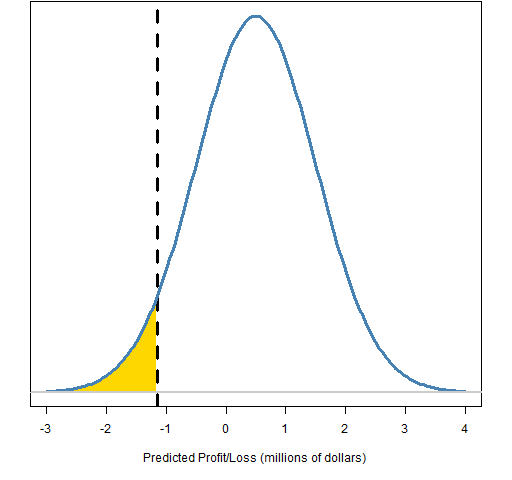

The basics of Value at Risk and Expected Shortfall | Portfolio Probe | Generate random portfolios. Fund management software by Burns Statistics